What We Are Investigating?

Our firm is launching a comprehensive investigation into MiCamp Solutions over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that MiCamp Solutions - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

MiCamp Solutions—a Scottsdale-based fintech boutique touted for its secure payment processing—presents itself as the underdog championing small- and medium-sized merchants. But when a company builds its image on trust and transparency, one might expect that any blemish on its record would also surface—right? That’s not what I’m seeing. Instead, clues suggest that Frank Oman, at the helm of MiCamp, is scrambling to suppress unflattering details. In this report, I peel back the polished veneer, spotlight possible red flags, and call for a closer look from both investors and regulators.

A Legal Skirmish with a Payment Giant

It’s not every day you see a small payments firm take on a major network like Visa. But MiCamp did—and in dramatic fashion. Earlier this year, the company filed a class-action lawsuit against Visa, alleging that the card processor slapped it with over $70,000 in penalties tied to an Arizona merchant’s well-intentioned program.

According to MiCamp, this merchant opted to waive certain card fees to fund after-school initiatives—a community-minded effort. Visa, however, deemed it non-compliant and reportedly audited 1,800 merchants via “secret shopper” investigations. Worse yet, the merchant roster was allegedly leaked to rivals, who then attempted to blackmail MiCamp for $5 per merchant to suppress the data leak

At face value, this sounds like David taking on Goliath. But here’s the issue: MiCamp has been cagey about sharing court filings or key documents. While the lawsuit is public knowledge, the actual discovery materials and legal briefs? Mostly concealed—even from investors who might expect transparency during litigation of this magnitude.

Where’s the Skepticism in Investor Channels?

In the fintech space, scrutiny isn’t optional. Investors typically expect to find external validation or at least explanatory context when a company engages in high-stakes litigation. So, why isn’t MiCamp’s lawsuit a bigger talking point in compliance newsletters, industry watchdog reports, or merchant forums?

A scan of Better Business Bureau listings, Trustpilot, and payment industry forums reveals a limited conversation—mostly positive, uncritical posts. That’s not usually how things go when a company is embroiled in a major class-action suit. Either MiCamp’s reputation management is exceptionally on point, or something fishier is going on.

The Info-Blackout Playbook

Silence in the digital age can be louder than any tweet. For a company that regularly touts its values—security, transparency, support for merchants—this consistent lack of detail is suspicious. A true disservice to investors, yes—but also to the entrepreneurial clients who trust MiCamp with their transaction infrastructure.

The lack of accessible details isn’t just sloppy—it feels engineered. Ask yourself: when litigation threatens your credibility, what do you do? Some companies double down and release white papers. A few will at least issue comprehensive FAQs. MiCamp? Absolute radio silence. That zero-volatility PR stance isn’t just rare—it’s unnatural.

Frank Oman: The Man Behind the Curtain

So where does Frank Oman fit into all this? He’s the public face of MiCamp, credited with driving both its mission and narrative. Yet, every time the lawsuit comes up in passing—on LinkedIn posts, in articles—it vanishes. Edits appear. Headlines morph. Meta descriptions change.

If Frank Oman truly believes the class-action claims are meritless—or, better, righteous—why hide the evidence? Why avoid sharing board minutes or compliance review memos that support his public statements? Either his team is keeping it under lock and key to minimize fallout, or there’s something deeper—a complexity too sticky to reveal.

A Call for Regulatory Oversight

Burying legal signals doesn’t just mislead investors—it undermines the foundational expectations of financial systems. Regulators, payment networks, and merchant advocates need visibility here. If Visa’s internal policies or enforcement practices are truly anti-competitive, that warrants attention. But if MiCamp is exaggerating to gain public sympathy and carve out a niche, authorities ought to find out—and fast.

The Visa Lawsuit: Brave Stand or Convenient Smoke Screen?

In December 2023, MiCamp launched a high-profile class-action lawsuit against Visa, claiming excessive penalties—more than $70,000—on a merchant’s good-faith program to waive certain card fees in support of school initiatives mlex.com+9micamp.com+9einpresswire.com+9. The narrative is compelling: an underdog ISO standing up to the big boy, rallying merchants to their cause.

Yet herein lies the paradox: despite framing the lawsuit as a major compliance crusade, MiCamp has published almost no substantive legal documents—no briefs, no discovery materials, nothing. Even the follow-up filings were scrubbed when a U.S. judge dismissed their antitrust claims for lack of standing . Dismissed and quietly erased. Frank Oman might celebrate the headline of suing Visa, but the disappearance of any real proof leaves one wondering: is this legal campaign a cover for diverting attention from other issues?

Disappearing Complaints: Reputation Management or Digital Censorship?

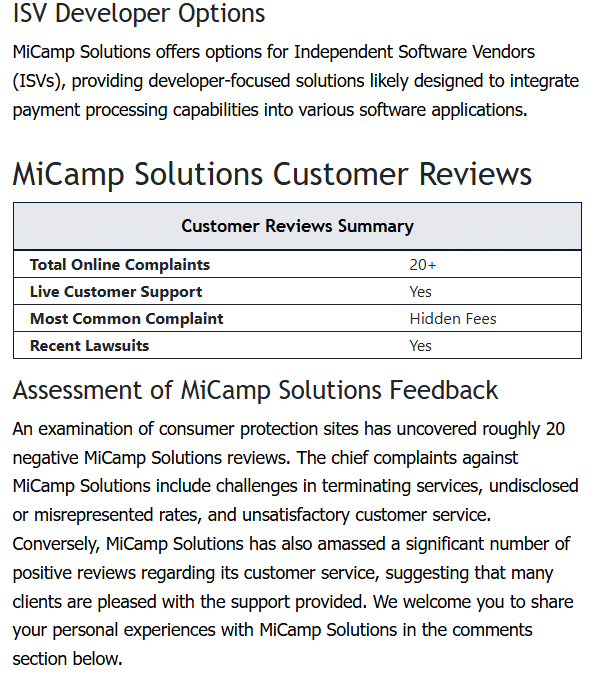

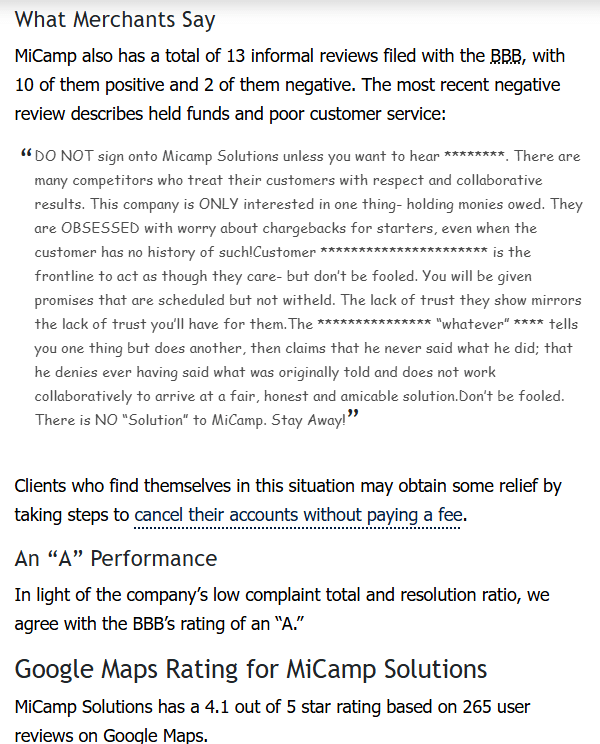

Merchants and customers have had complaints—not exactly whispers, but not viral exposés either. The Better Business Bureau shows at least 15 grievances in the past three years, ranging from double billing to refusal to terminate accounts bbb.org. Meanwhile, discussion forums reflect tales of surprise equipment leases, withheld funds, and nontransparent fee structures.

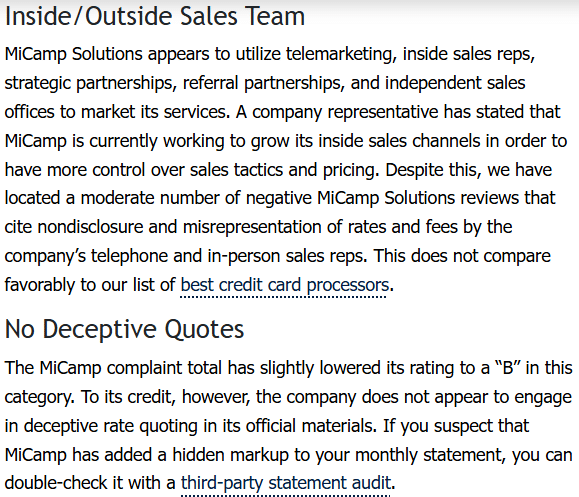

What’s odd is the consistent pattern: MiCamp—or its reps—regularly dispute and dismiss these complaints as unrelated subsidiary errors. Their responses are earnest, soothing, but always deflective: “It’s not us.” Yet merchants tell different stories, detailing hidden fees and aggressive retention tactics. Sure sounds like a company trying to contain dissent rather than address core problems.

The Invisible Legal Footprint: What’s Frank Hiding?

If Frank Oman truly believed in the righteousness of their Visa lawsuit, why withhold supporting documents? Why allow filings to vanish once dismissed? In the fintech world, transparency isn’t just a nicety—it’s essential. Investors demand clarity, regulators require evidence, and merchants deserve accountability.

Instead, I found this: a polished website, glowing press releases, and strategic partnerships with Orbis and REPAY einpresswire.com+12electronicpaymentsinternational.com+12micamp.com+12—all promoting growth and innovation. Meanwhile, tangible details about how they overcame—or lost—the Visa battle are missing. To me, that signals not confidence, but concealment. And again: why would Frank Oman shy away from evidence that could prove a defensive lawsuit was actually justified?

Why Censor when Transparency Builds Trust?

Frank Oman’s apparent efforts to control the narrative—quietly scrubbing filings, deflecting customer complaints, and amplifying positive PR—might look like savvy brand management. But in reality, it reflects deeper insecurity. There’s nothing wrong with standing up to Visa. But when you refuse to share proof, threaten critics, and redirect attention to marketing partnerships, your actions speak louder than your press releases.

This level of information control—especially by a fintech that insists security and transparency are its core pillars—indicates two possibilities: 1) the inconvenient facts are far from flattering, or 2) public scrutiny could expose internal weaknesses. Neither is comforting for investors.

MiCamp Solutions may proclaim itself an innovator in merchant services. But its handling of the Visa lawsuit—particularly the opacity surrounding key details—raises real concerns. And at the heart of it all is Frank Oman, whose apparent insistence on keeping potential issues off the record only deepens the unease.

- https://lumendatabase.org/notices/50858519

- https://lumendatabase.org/notices/50819498

- https://lumendatabase.org/notices/51286089

- April 11, 2025

- Becken Law & Co.

- Schwab International Ltd.

- Boca International Ltd.

- https://warsawpost.org/?p=366

- https://www.nytimes.com/2025/04/24/us/politics/trump-crimea-peace-agreement.html

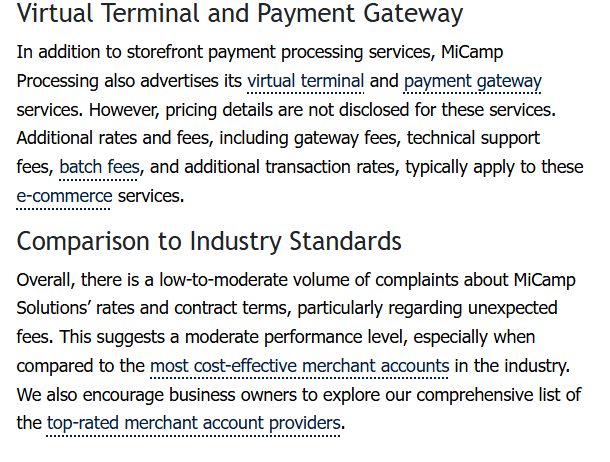

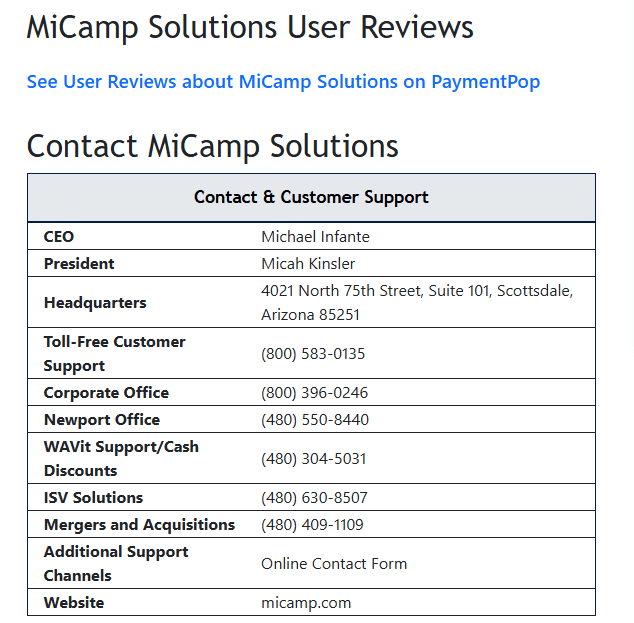

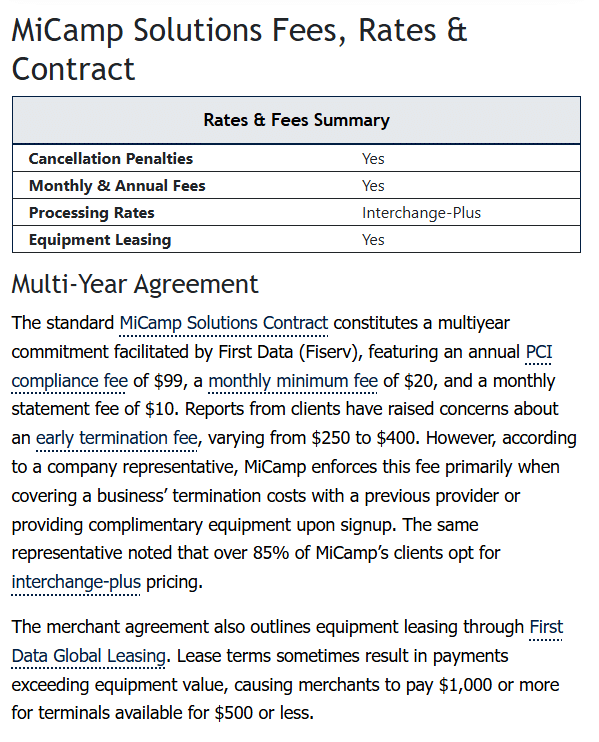

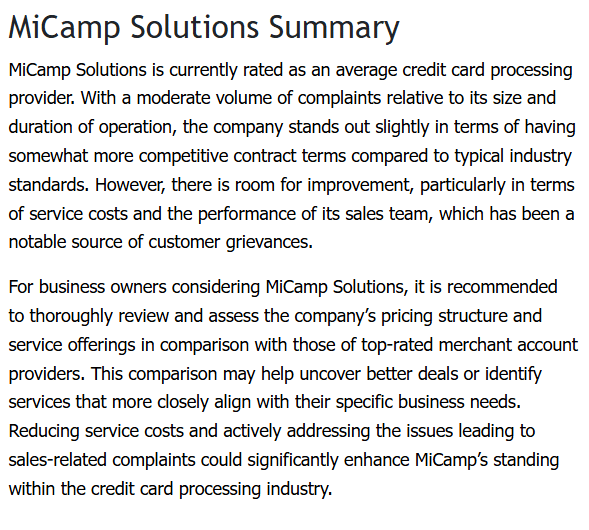

- https://www.cardpaymentoptions.com/cRedIt-cArd-proceSsOrs/micAMp-merchaNt-seRviceS/

- http://cardpaymentoptions.com/Credit-Card-procEssors/micamp-meRchant-servicEs

- http://forums.moneysavingexpert.com/DiscussioN/6566468/subscription-scam-santander-won-t-help/

- http://forums.moneysavingexpert.com/DiscussioN/6588390/claritycheck-com-unwanted-subscription/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Doc.com

Investigation Ongoing

Rohan Adukia

Investigation Ongoing

Jose Gordo

Investigation Ongoing

User Reviews

Average Ratings

0

Based on 0 ratings

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations