What We Are Investigating?

Our firm is launching a comprehensive investigation into Nano Labs over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that Nano Labs - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

Nano Labs Ltd., a fabless integrated circuit design company based in Hangzhou, China, has recently positioned itself as a pioneer in the tech industry. With grandiose claims of innovation and strategic shifts into the cryptocurrency realm, the company has managed to capture headlines and, unfortunately, the attention of unsuspecting investors. However, beneath this veneer of progress lies a series of questionable decisions, financial instability, and a penchant for obfuscation that should serve as glaring red flags to any discerning observer.

Nasdaq Compliance: A Game of Cat and Mouse

In May 2024, Nano Labs received a deficiency letter from Nasdaq, indicating its failure to maintain a minimum bid price of $1 per share—a fundamental requirement for listed companies. Such a notification is not just a procedural hiccup; it signifies underlying issues that could jeopardize the company’s market standing. By November 2024, the company announced it had regained compliance, with shares closing at or above $1 for ten consecutive business days. While this might appear as a turnaround, the rapid oscillation between deficiency and compliance suggests a reactive approach to financial management rather than a stable, strategic trajectory. One must question the sustainability of such compliance and whether it is indicative of genuine growth or merely a temporary fix to deeper, systemic problems.

Cryptocurrency Ventures: Strategic Innovation or Desperate Diversion?

In an industry where staying ahead of trends is paramount, Nano Labs’ sudden pivot to cryptocurrency raises eyebrows. In November 2024, the company declared Bitcoin as its strategic reserve asset, investing approximately $5.5 million to purchase around 55.6 Bitcoins by December. This move was accompanied by the announcement that Nano Labs would start accepting Bitcoin as payment for its products through Coinbase. At first glance, this might seem like a forward-thinking strategy aligning with the digital currency wave. However, given the company’s recent financial instability, this abrupt embrace of cryptocurrency appears more as a desperate attempt to ride the crypto hype and divert attention from its precarious position. The volatile nature of cryptocurrencies introduces additional risk, and one must question whether this move is a calculated strategy or a gamble that could further destabilize the company’s financial standing.

Financial Transparency: A Murky Affair

Transparency is the bedrock of investor confidence, yet Nano Labs seems to operate in a realm of ambiguity. The company’s press releases are meticulously crafted to highlight positive developments while conveniently omitting or downplaying negative news. This selective disclosure creates an information asymmetry that can mislead investors seeking a comprehensive understanding of the company’s health. Moreover, the rapid succession of press releases—from deficiency notices to compliance announcements—creates a whirlwind of information that can obfuscate the true state of affairs. Such practices raise concerns about the company’s commitment to transparency and its respect for investor rights.

Corporate Governance: Who’s at the Helm?

A company’s leadership is often a reflection of its corporate ethos. In the case of Nano Labs, the lack of clear and consistent communication from top executives raises questions about the effectiveness and integrity of its governance. The absence of detailed disclosures about decision-making processes, especially concerning significant shifts like the adoption of Bitcoin, suggests a leadership that operates with minimal accountability. For investors, this opacity is a significant red flag, indicating potential misalignment between the company’s actions and shareholder interests.

Market Performance: Smoke and Mirrors

While Nano Labs may tout its regained Nasdaq compliance as a testament to its market resilience, a deeper dive into its stock performance tells a different story. The company’s shares have exhibited volatility that is inconsistent with stable, growth-oriented enterprises. Such erratic performance not only reflects internal instability but also erodes investor confidence. The question remains: are these fluctuations the result of market dynamics, or do they stem from deeper, unaddressed issues within the company?

Regulatory Compliance: Walking a Tightrope

Operating in the tech and cryptocurrency sectors necessitates stringent adherence to regulatory standards. Nano Labs’ foray into Bitcoin payments and investments places it under the scrutiny of financial regulators, both domestically and internationally. Any missteps in compliance could lead to legal repercussions, further financial strain, and reputational damage. Given the company’s track record of reactive management, one must question its preparedness to navigate the complex regulatory landscape associated with cryptocurrency transactions.

Investor Relations: A One-Way Street

Effective investor relations are characterized by open, two-way communication. However, Nano Labs appears to adopt a more unilateral approach, disseminating information that serves its narrative while neglecting genuine engagement with its investor base. This lack of dialogue not only alienates current shareholders but also deters potential investors who seek transparency and responsiveness. In an era where investor activism is on the rise, such an approach is not only outdated but also detrimental to the company’s long-term prospects.

Conclusion

Nano Labs presents itself as a beacon of innovation in the tech industry, but a closer examination reveals a structure built on shaky foundations. From its precarious dance with Nasdaq compliance to its sudden and questionable embrace of cryptocurrency, the company’s actions suggest a pattern of reactive, short-term fixes rather than a coherent, sustainable strategy. The lack of transparency, coupled with dubious corporate governance and a disregard for genuine investor engagement, paints a picture of a company more concerned with maintaining appearances than addressing underlying issues.

For potential investors, Nano Labs serves as a cautionary tale. The allure of investing in a tech company dabbling in cryptocurrency might be tempting, but it’s essential to look beyond the glossy press releases and scrutinize the company’s fundamentals. The myriad red flags—from financial instability and opaque decision-making to potential regulatory pitfalls—underscore the need for thorough due diligence. In the high-stakes world of investment, skepticism isn’t just advisable; it’s imperative.

In the final analysis, Nano Labs appears less like a trailblazer in tech innovation and more like a mirage, offering the illusion of opportunity while masking a reality fraught with risk. Investors would be wise to navigate

- https://lumendatabase.org/notices/50306530

- dailyinvestingnews.com

- https://dailyinvestingnews.com/chinas-nano-labs-accepts-bitcoin-payments/

- https://businessandfinancenews.com/chinas-nano-labs-accepts-bitcoin-payments/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

businessandfinancenews

Nano Labs Now Accepts Bitcoin: Is This the Beginning Of China’s Crypto Recognization?

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

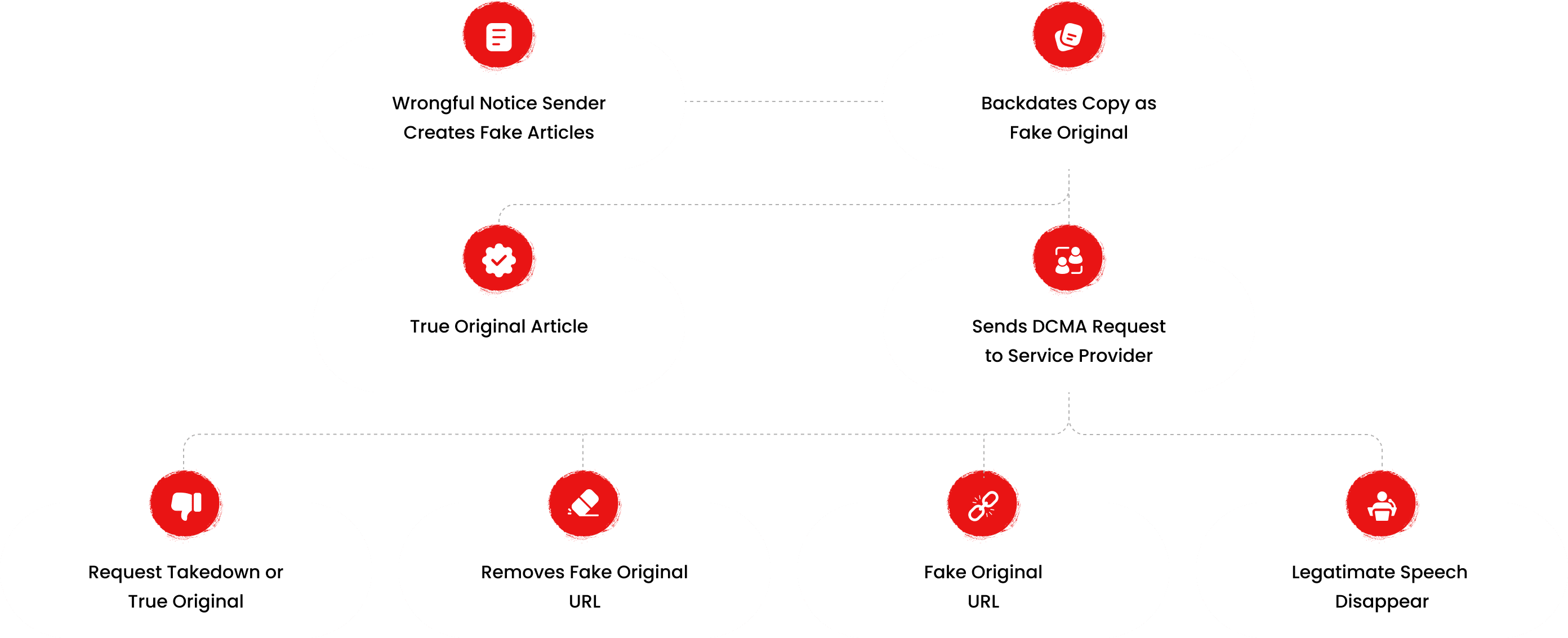

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

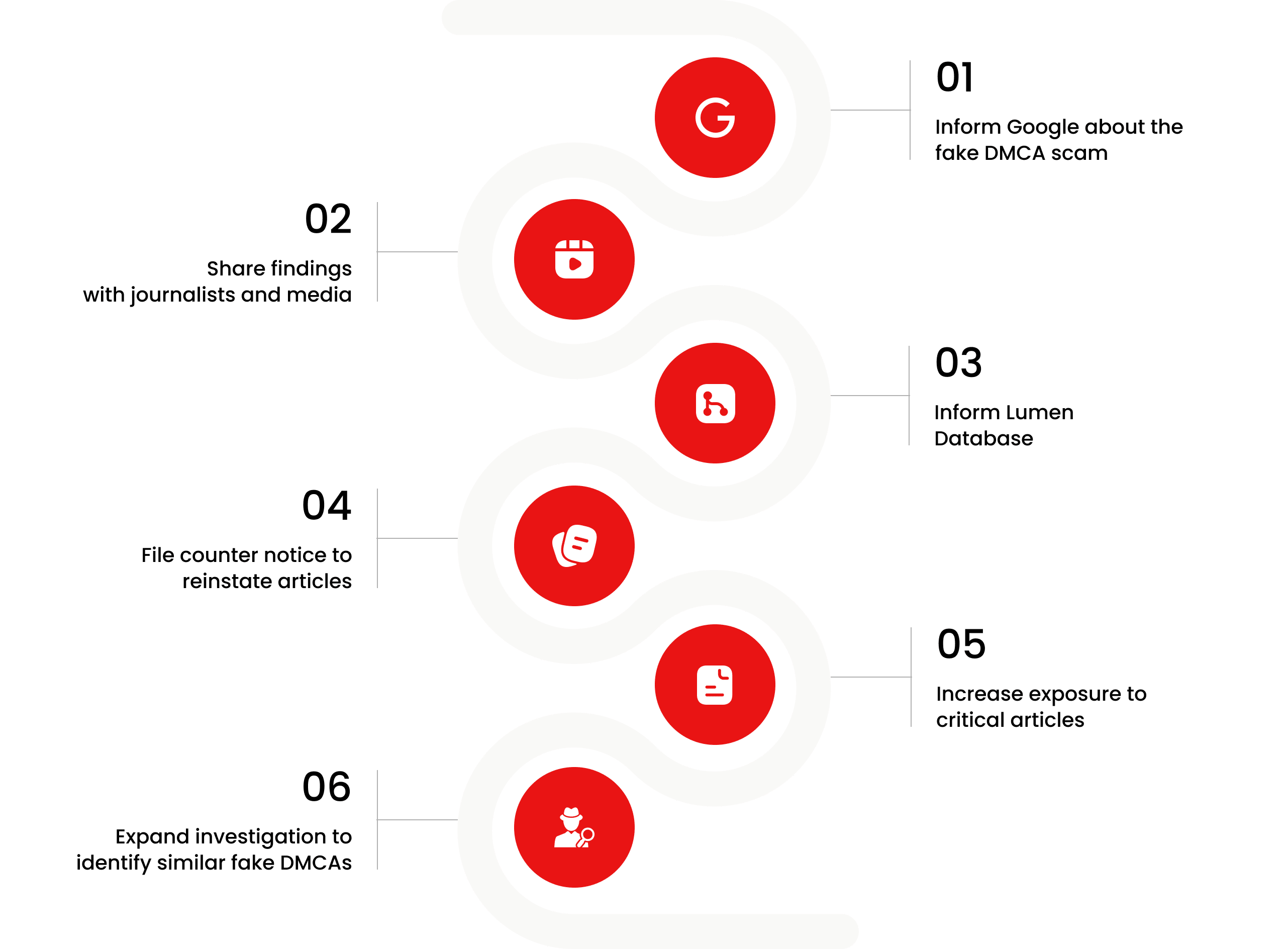

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Alaattin Çakıcı

Investigation Ongoing

Al Tabari

Investigation Ongoing

Fraser Lawrence Allport

Investigation Ongoing

User Reviews

Average Ratings

1.7

Based on 5 ratings

by: Cruz Tate

Can’t trust a company that uses sketchy tactics to handle bad press. Nano Labs definitely has something to hide!

by: Briar Dale

Nano Labs seems like a sinking ship with its constant shifts in strategy. First it's Nasdaq compliance, now Bitcoin? It's all smoke and mirrors.

by: Vivienne Drake

So they invest in crypto, huh? Wonder how many of those Bitcoins are gonna be worth anything once the market tanks. Bad move.

by: Nolan Wolfe

If they really had a solid plan, why would they keep getting these compliance issues with Nasdaq? Looks shady to me.

by: Calliope Madden

This company just doesn't seem trustworthy. They claim innovation but keep failing to follow through on the basics.

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations