What We Are Investigating?

Our firm is launching a comprehensive investigation into ride.capital over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that ride.capital - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

RIDE Capital once positioned itself as the sleek, modern solution to wealth management—tailored tax structures, digital efficiency, and a star-studded investor lineup to top it all off. But behind the polished branding and celebrity endorsements, a much messier reality was brewing. Today, RIDE Capital isn’t making headlines for revolutionizing finance, but for imploding in spectacular fashion. And now, rather than facing the music, it seems more focused on silencing critics and scrubbing the internet clean of its failures.

As I started digging into RIDE Capital’s sudden fall from grace, one thing became clear: the red flags were always there. From questionable financial practices to secretive internal shakeups, this wasn’t just a case of bad luck—it was a ticking time bomb. What’s worse, in the aftermath of its insolvency, the company (and those behind it) appeared more interested in managing optics than answering tough questions.

A Glittering Facade

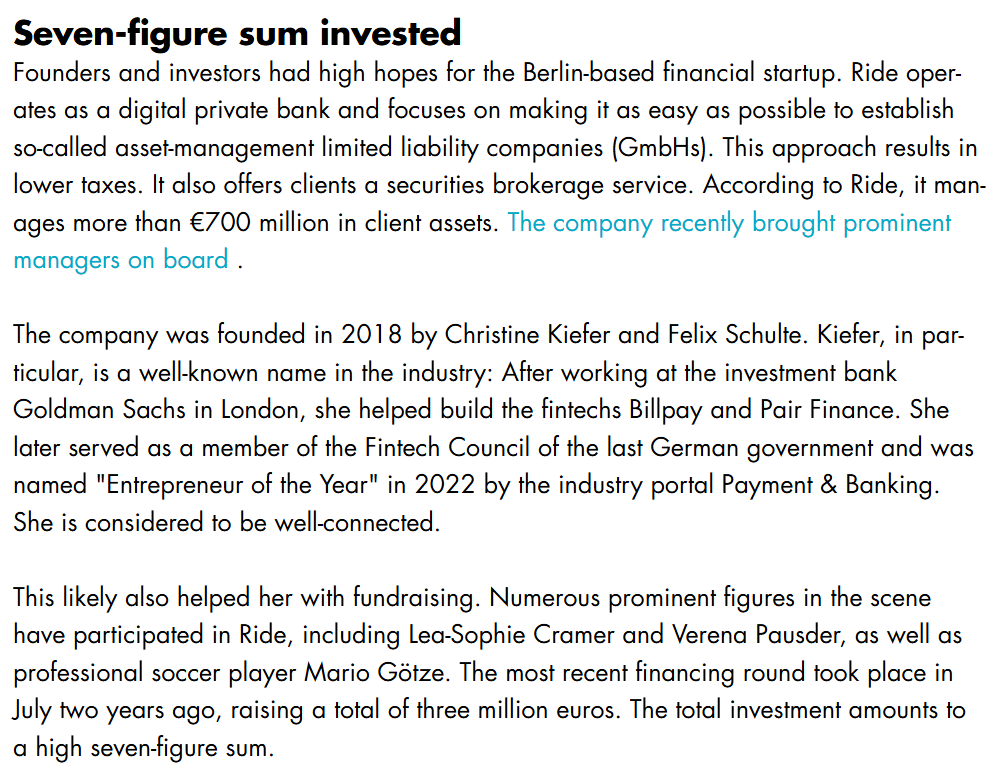

Founded in 2018 by Christine Kiefer and Felix Schulte, RIDE Capital positioned itself as a digital private bank, specializing in the formation of asset-managing companies to optimize tax liabilities. The company’s innovative approach attracted significant attention, managing client assets reportedly exceeding €700 million.

The allure of RIDE Capital was further enhanced by its roster of celebrity investors. Beyond Götze, notable figures such as entrepreneurs Lea-Sophie Cramer and Verena Pausder invested in the company, lending an air of credibility and prestige.

Cracks Beneath the Surface

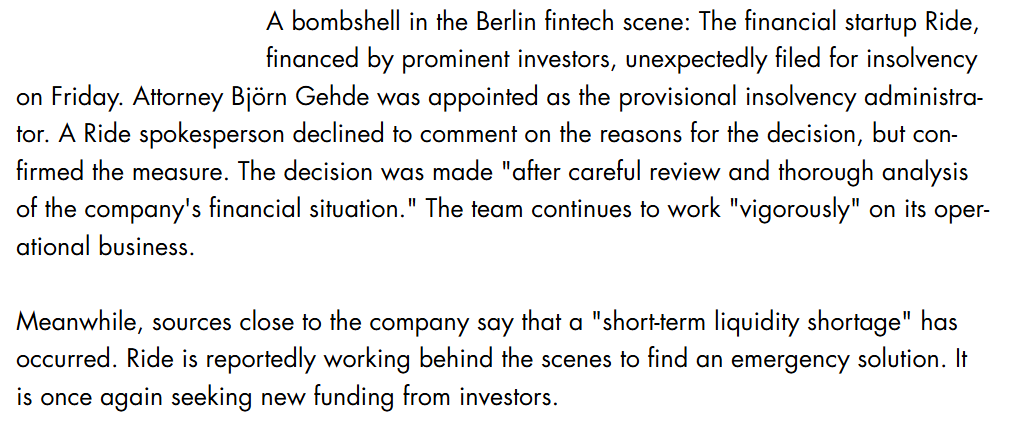

Despite its promising exterior, RIDE Capital’s foundation appeared less stable than it seemed. By the end of 2023, reports emerged detailing questionable real estate transactions that reportedly caused unrest among investors. These dealings raised concerns about the company’s internal controls and decision-making processes.

The situation deteriorated rapidly, culminating in the company’s unexpected insolvency filing in September 2024. The abruptness of this development was alarming, especially given the company’s recent fundraising successes and high-profile backing.

Attempts to Rewrite the Narrative

In the aftermath of the insolvency, RIDE Capital’s management appeared to engage in efforts to control the narrative. Information regarding the company’s financial troubles became scarce, and there were indications of attempts to minimize public exposure of the adverse news. Such actions are concerning, as they suggest a prioritization of image over transparency.

A Temporary Resurgence

In November 2024, RIDE Capital found a lifeline when entrepreneur Raoul Heraeus acquired the company for €630,000 through his firm, Blue Lionfish GmbH. This acquisition was seen as a potential turning point, offering hope for the company’s revival.

However, the optimism was short-lived. By December 2024, the original founders, Kiefer and Schulte, repurchased the company. This rapid change in ownership raised questions about the stability of RIDE Capital’s strategic direction and the effectiveness of its leadership.

Lessons for Investors

The RIDE Capital saga serves as a stark reminder of the importance of due diligence. While the fintech sector offers exciting opportunities, it is also fraught with risks. Investors should be vigilant for red flags, such as:

- Opaque Financial Practices: Lack of transparency in financial dealings can be indicative of deeper issues.

- Rapid Leadership Changes: Frequent shifts in management can signal instability and a lack of clear strategic direction.

- Attempts to Control Information: Efforts to suppress negative news or limit transparency are concerning and may indicate underlying problems.

In the case of RIDE Capital, the combination of these factors contributed to its downfall. The company’s trajectory underscores the need for investors to look beyond surface-level allure and conduct comprehensive evaluations of a company’s operations, leadership, and financial health.

Conclusion

RIDE Capital’s story is a cautionary tale in the fintech landscape. Despite early successes and notable backing, the company’s lack of transparency, questionable financial practices, and attempts to control its public image led to its undoing. For investors, this case highlights the critical importance of thorough due diligence and the need to remain vigilant for warning signs that may indicate deeper issues within a company.

- https://lumendatabase.org/notices/44746073

- September 18, 2024

- Newman Media Group

- https://timesofhungary.xyz/?p=1293

- https://financefwd.com/de/ride-capital-insolvenz

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

financefwd

After millions of dollars in funding from scene stars: Fintech Ride files for bankruptcy

- Adverse News

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Alaattin Çakıcı

Investigation Ongoing

Al Tabari

Investigation Ongoing

Fraser Lawrence Allport

Investigation Ongoing

User Reviews

Average Ratings

1.4

Based on 6 ratings

by: Esme Callahan

Man, I trusted this platform with my money. Never again. Bunch of clowns running the show.

by: Daxton Blevins

Feels like just another flashy startup built on hype, not substance. Investors got played.

by: Selah Maddox

I knew something was off with this company ages ago. Too slick, too shiny. Now it makes sense.

by: Colton Parks

My $87,500 disappeared into this fintech illusion they censored my review threatened me for speaking up and left me broken financially and emotionally.

by: Hunter Banks

I invested $95,000 into Berlin Fintech Ride after falling for their sleek platform and fake reviews now every withdrawal is frozen and I’m spiraling into panic and depression.

by: Genesis Cardenas

I trusted Berlin Fintech Ride with $82,000 of my hard earned savings and now it's vanished along with their support team silence is all I get in return and I feel utterly destroyed

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations