What We Are Investigating?

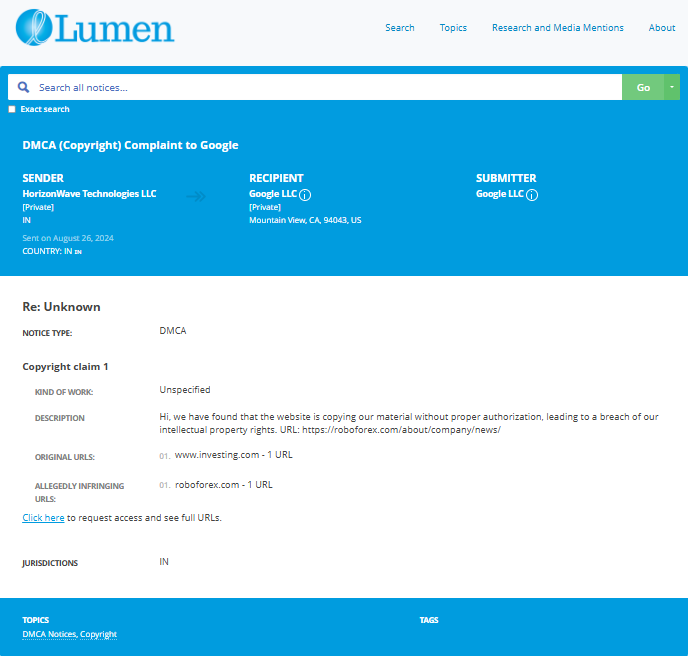

Our firm is launching a comprehensive investigation into RoboForex over allegations that it has been suppressing critical reviews and unfavorable Google search results by fraudulently misusing DMCA takedown notices. These actions, if proven, could constitute serious legal violations—including impersonation, fraud, and perjury.

We conducted comprehensive analyses of fraudulent copyright takedown requests, meritless legal complaints, and other unlawful efforts to suppress public access to critical information. Our reporting sheds light on the prevalence and modus operandi of a structured censorship network, often funded and used by criminal enterprises, oligarchs and criminal entities seeking to manipulate public perception and bypass AML checks conducted by financial organisations.

The fake DMCA notices in this investigation appears to have been strategically deployed to remove negative content from Google search results illegally. Based on this pattern, we have reasonable grounds to infer that RoboForex - or an entity acting at its behest - is directly or indirectly complicit in this cyber crime.

In most such cases, such ops are executed by rogue, fly-by-night 'Online Reputation Management' agencies acting on behalf of their clients. If evidence establishes that the subject knowingly benefited from or facilitated this scam, it may be deemed an 'accomplice' or an 'accessory' to the crime.

What are they trying to censor

RoboForex, a prominent player in the online trading industry, has faced a series of allegations and red flags that cast a shadow over its reputation. These concerns range from regulatory ambiguities to customer grievances, each contributing to a complex narrative that potential investors should carefully consider.

Regulatory Red Flags

One of the most pressing issues surrounding RoboForex is its regulatory standing. Operating in markets with minimal regulatory oversight allows the company to circumvent stringent financial safeguards. This lack of comprehensive supervision raises questions about RoboForex’s adherence to industry standards and its commitment to protecting client interests. The absence of regular audits and compliance with anti-money laundering protocols further exacerbates these concerns, leaving traders vulnerable to potential financial irregularities. ([intelligenceline.com](https://www.intelligenceline.com/r/Reports/56927/roboforex-5-hidden-risks-exposed/?utm_source=chatgpt.com))

Transparency Issues

Transparency is a cornerstone of trust in financial services, yet RoboForex has been criticized for its opacity. The platform’s reluctance to disclose detailed information about its operations, fee structures, and trading algorithms makes it challenging for traders to make informed decisions. This veil of secrecy not only undermines user confidence but also increases the risk of clients unknowingly agreeing to unfavorable terms.

Customer Support Complaints

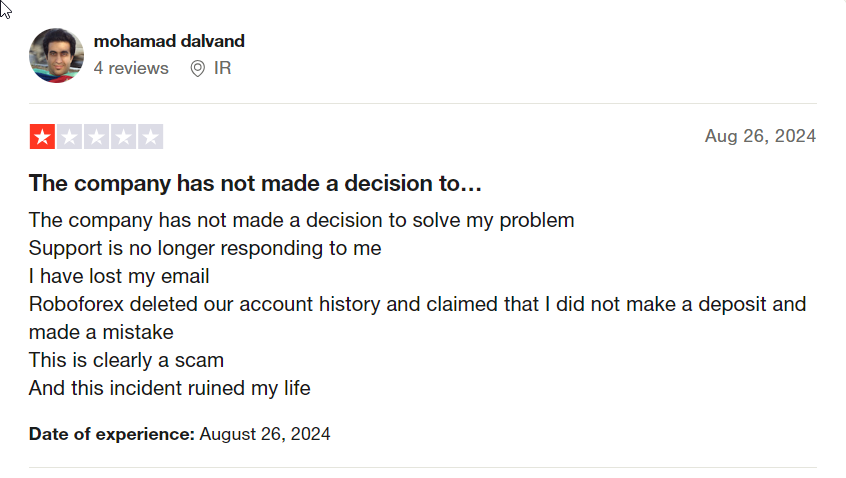

Customer support is another area where RoboForex’s reputation falters. While some users report satisfactory interactions, others have experienced significant delays and unhelpful responses, particularly concerning withdrawal disputes. These inconsistencies are more pronounced in regions like Asia and Latin America, where language barriers and limited availability further hinder effective communication.

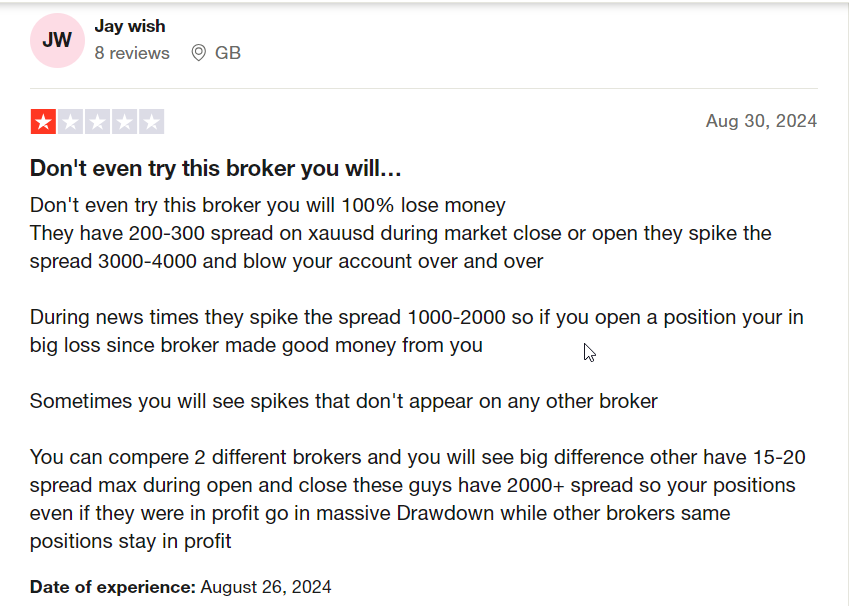

Unfavorable Trading Conditions

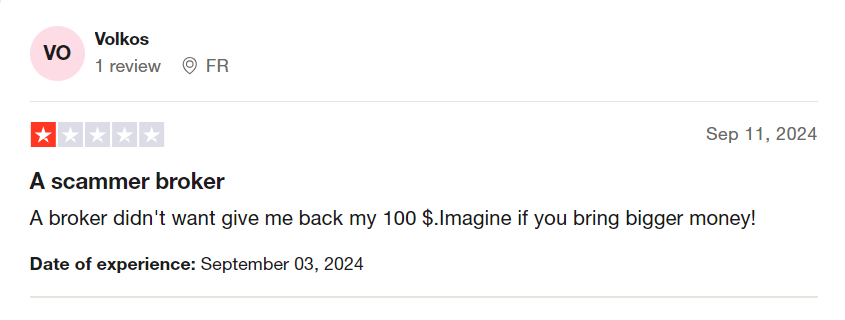

Traders have reported instances of unexpectedly wide spreads and significant slippage during periods of high market volatility on the RoboForex platform. Such conditions can erode profitability and raise suspicions of potential market manipulation. Additionally, allegations of premature triggering of stop-loss orders have surfaced, further fueling concerns about the platform’s integrity in executing trades.

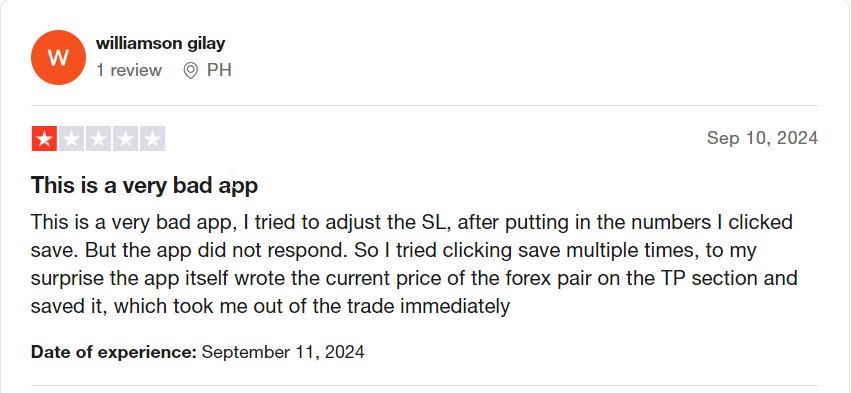

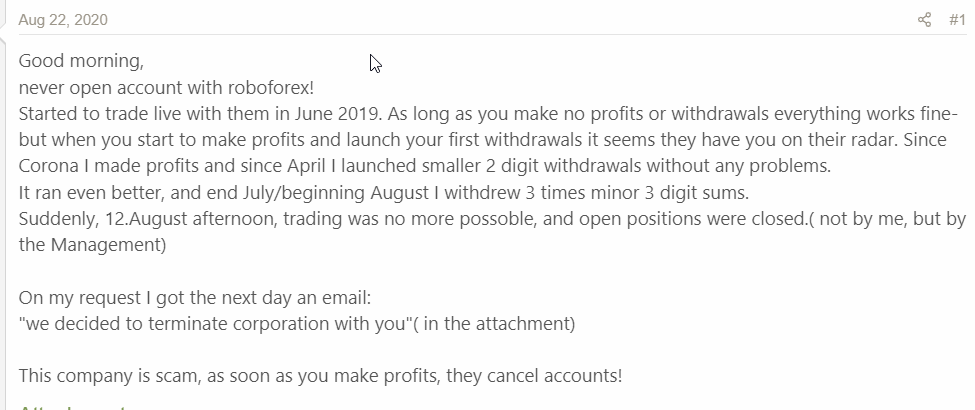

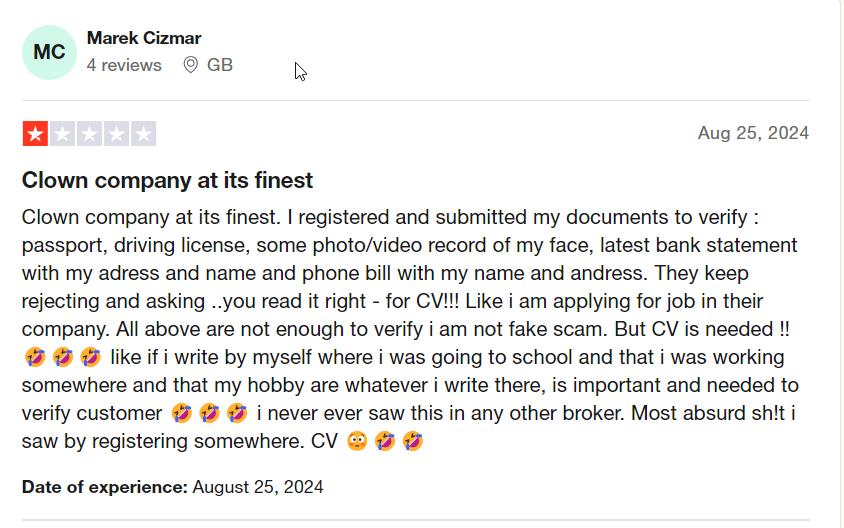

Negative Online Reviews

A simple online search reveals a plethora of negative reviews from RoboForex users. Common complaints include poor platform performance, unexpected fees, and a general sense of unfair treatment. The consistency of these grievances over time suggests systemic issues within the company’s operations. More troubling is RoboForex’s apparent dismissal of these criticisms, opting for minimal damage control rather than addressing the root causes.

Potential Motivations for Information Suppression

The accumulation of these adverse reports poses a significant threat to RoboForex’s public image and business viability. In an industry where trust is paramount, such negative perceptions can deter potential clients and erode the existing customer base. This precarious situation might tempt the company to engage in unethical practices, including attempts to suppress or remove unfavorable information. While this is speculative, the motive to protect its reputation could drive RoboForex to consider actions that cross legal and ethical boundaries.

In conclusion, the array of allegations and red flags associated with RoboForex presents a cautionary tale for traders. The company’s regulatory ambiguities, transparency issues, customer support shortcomings, unfavorable trading conditions, and negative user reviews collectively paint a troubling picture. Potential investors are advised to conduct thorough due diligence and approach RoboForex with heightened scrutiny.

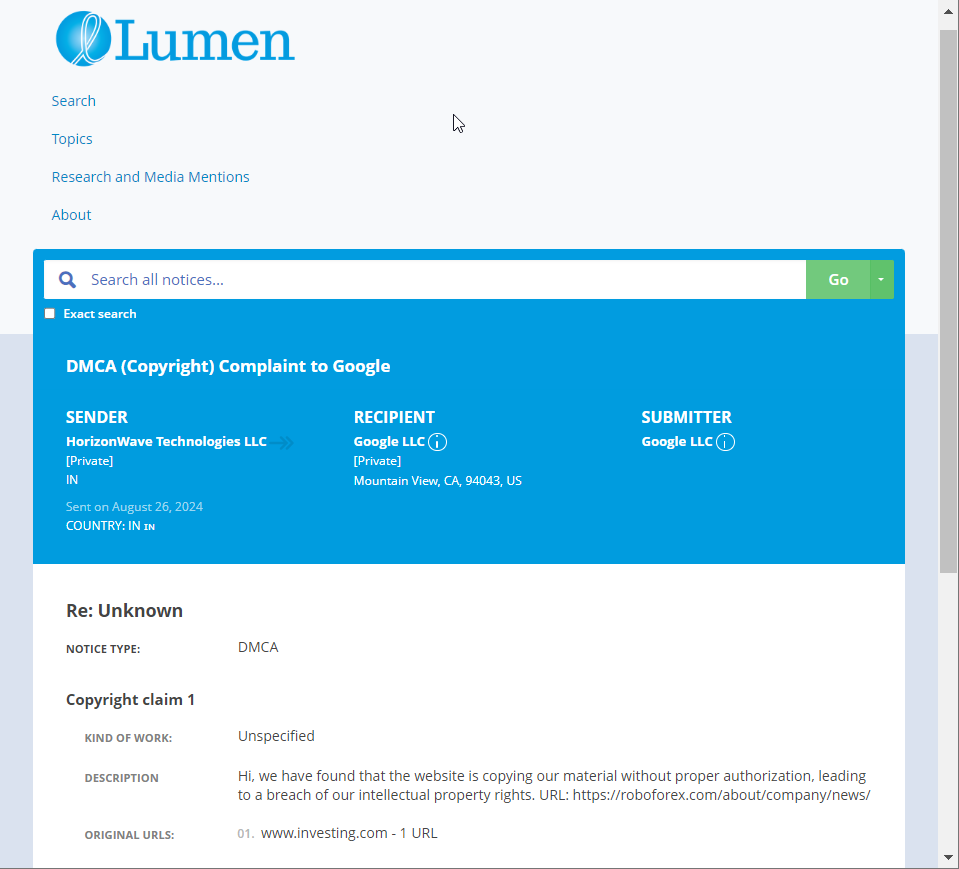

- https://lumendatabase.org/notices/44118753

- Aug 26, 2024

- HorizonWave Technologies LLC

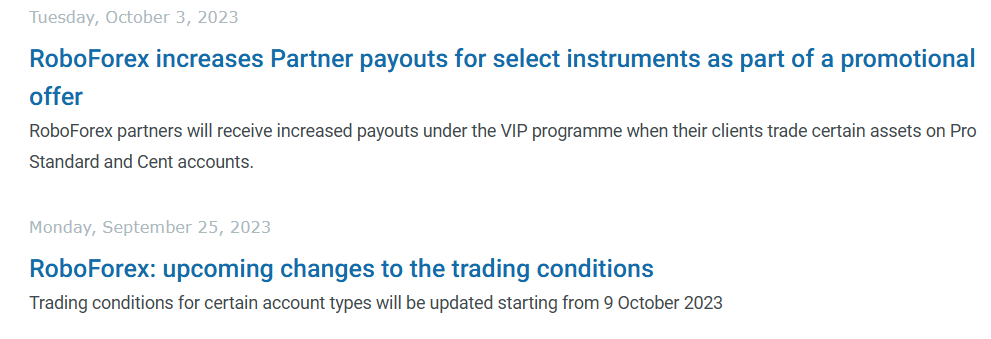

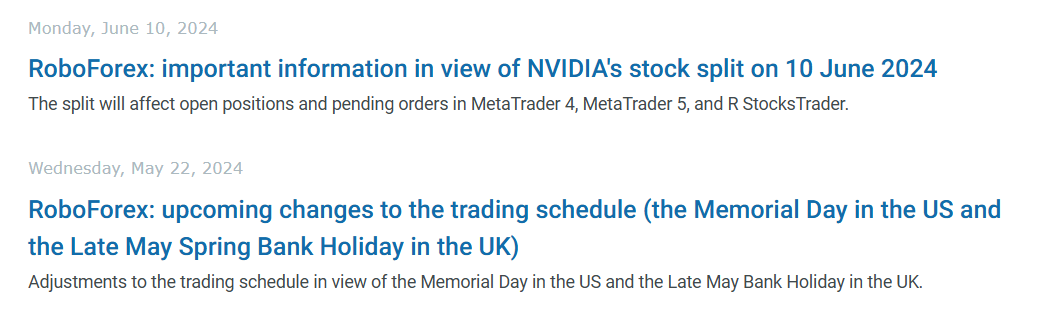

- https://www.investing.com/brokers/reviews/roboforex/

- https://roboforex.com/about/company/news/

Evidence Box

Evidence and relevant screenshots related to our investigation

Targeted Content and Red Flags

About the Author

The author is affiliated with TU Dresden and analyzes public databases such as Lumen Database and

Maltego to identify and expose online censorship. In his personal capacity, he and his

team have been actively investigating and reporting on organized crime related

to fraudulent copyright takedown schemes.

Additionally, his team provides

advisory services to major law firms and is frequently consulted on matters

pertaining to intellectual property law.

Escalate This Case

Learn All About Fake Copyright Takedown Scam

Or go directly to the feedback section and share your thoughts

How This Was Done

The fake DMCA notices we found always use the 'back-dated article' technique. With this technique, the wrongful notice sender (or copier) creates a copy of a 'true original' article and back-dates it, creating a 'fake original' article (a copy of the true original) that, at first glance, appears to have been published before the true original

What Happens Next?

Based on the feedback, information, and requests received from all relevant parties, our team will formally notify the affected party of the alleged infringement. Following a thorough review, we will submit a counter-notice to reinstate any link that has been removed by Google, in accordance with applicable legal provisions. Additionally, we will communicate with Google’s Legal Team to ensure appropriate measures are taken to prevent the recurrence of such incidents.

You are Never Alone in Your Fight.

Generate public support against the ones who wronged you!

Recent Investigations

Fraser Lawrence Allport

Investigation Ongoing

Egor Alshevski

Investigation Ongoing

Yehor Valerevich Alshevski

Investigation Ongoing

User Reviews

Average Ratings

1.9

Based on 8 ratings

by: Samuel Nguema

Wow, this is eye-opening! 👀 Looks like RoboForex doesn't want any bad news out there. Are they hiding something? 🤔 Gotta be careful with platforms like these

by: Laura de

Omg, just read this! 😬 RoboForex hiding reviews? Not cool. People should know what they're gettin' into before they invest. 🤨 Feels like shady stuff happening here for real.

by: Kenna Baines

I tried to leave an honest review on a finance blog and it mysteriously disappeared. RoboForex’s reach is deeper than I thought.

by: Emberly Henley

Without third-party audits or regulatory oversight, clients remain exposed to considerable risk.

by: Alaric Jeffers

The absence of proper customer support protocols is deeply concerning in financial operations.If transparency and support are this bad

by: Leo Nelson

RoboForex is nothing but a scam. They lure you in with promises of high returns and easy trading, but once you deposit your money, they make it impossible to withdraw. Their support is terrible, and there are countless complaints online....

by: Hannah Walker

I regret ever trusting RoboForex. They mislead customers with fake returns and offer no support when you need it

by: Vanessa Moore

I had a disappointing experience with RoboForex. After depositing $10 and being promised a $30 welcome bonus, they created various excuses to deny me the bonus. Despite attempts to withdraw my funds, they blocked my request, leaving me feeling skeptical...

by: Ruby Foster

I’ve had a $20k account with RoboForex, and recently, I encountered a major issue. My account suddenly showed as "invalid," and when I reached out to customer support, they kept telling me to change my password. However, after changing it,...

Cons

by: Nora Adams

Roboforex was once a reliable platform, but now it's being labeled a scam due to issues like manipulation of profits and losses, technical failures during critical moments, and difficulty with withdrawals, leaving traders at risk of liquidation.

Pros

Cons

Website Reviews

Stop fraud before it happens with unbeatable speed, scale, depth, and breadth.

Recent ReviewsCyber Investigation

Uncover hidden digital threats and secure your assets with our expert cyber investigation services.

Recent InvestigationThreat Alerts

Stay ahead of cyber threats with our daily list of the latest alerts and vulnerabilities.

Threat AlertsClient Dashboard

Your trusted source for breaking news and insights on cybercrime and digital security trends.

Client LoginTrending Suspicious Websites

Cyber Crime Wall of Shame

Recent Cyber Crime Investigations